The tax on companies is going up

There are some big tax changes scheduled to be introduced over the next couple of years, which means that company tax bills are going up. You can mitigate some of the tax increases by thinking ahead and acting appropriately. This note provides you with some pointers and themes to consider.

Corporation tax is increasing

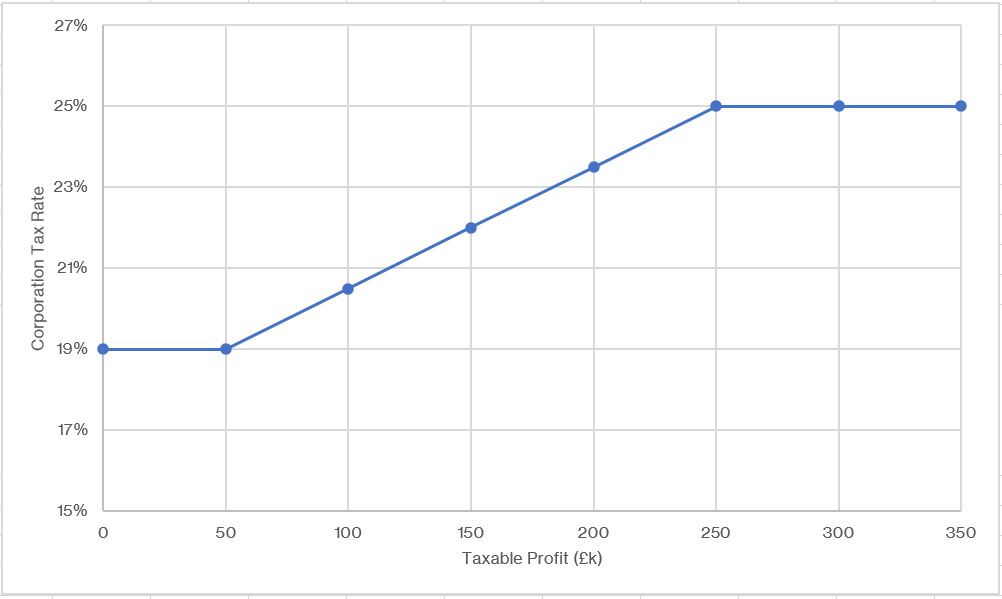

As explained above, from 1/4/2023 UK Corporation Tax for companies with profits of more than £50k will increase. At the moment, most companies pay 19% Corporation Tax. But from 1/4/2023 corporation tax will increases so that companies with profits of more than £250k will pay 25% Corporation Tax. Corporation Tax for companies with profits of between £50k and £250k will also increase. See the chart below.

National Insurance is increasing

From April this year National Insurance will increase by 2.5% – 1.25% for employers and 1.25% for employees. You can read about this in our note here. The table illustrates how contributions stand at present and how they will look after 1st April 2022, at the start of the new tax year.

| Employee’s NI | Employer’s NI | |

| Currently | 12.00% | 13.80% |

| From April 1st 2022 | 13.25% | 15.05% |

Tax incentives to invest are decreasing

In addition to the above, some significant tax incentives to invest are being removed or downgraded. In particular the ‘Super Deduction’ for capital expenditure ends on 31/3/2023. (You may remember, the Super Deduction means that most investment (not cars) qualify for a 130% tax deduction). Also, the £1million Annual Investment Allowance ends on 31/3/2023 and is replaced by a £200k Annual Allowance. This means that after 31/3/2023 only £200k of capital investment can be relieved against profits in the year incurred.

Dividend tax is increasing

From 6 April 2022 the tax applicable to dividends will increase by 1.25%. The dividend ordinary rate will be set at 8.75% (compared with 7.5%), the dividend upper rate will be set at 33.75% (compared with 32.5%) and the dividend additional rate will be set at 39.35 (compared with 38.1%).

Tax saving opportunities

I’m not really sure that ‘Tax saving opportunities’ is quite the correct description. Its probably more accurate to say Tax mitigation opportunities. But let’s look at some basic ideas.

Idea 1 – Bring dividend payments forward and pay off directors’ loan accounts

Since dividend tax increases from 6/04/2022 its worth paying yourself a higher dividend before this. Similarly, since the tax rate that applies to overdrawn director’s loan accounts is linked to the dividend upper rate, its worth clearing (or writing off) the director’s account before 6/4/2022.

Idea 2 – Bring forward income and defer revenue expenditure

It may be that you can bring income forward to an accounting period that ends before 31/3/2023. Likewise, you might be able to defer revenue expenditure to an accounting period that ends after 31/3/2023. Both of these approaches will save tax. So, it might be worth, for example, offering slightly better terms on a contract to get it signed more quickly or delaying hiring a person. Note that when your thinking about delaying expenditure its important to distinguish between capital and revenue expenditure. Be careful about delaying capital expenditure – because you risk losing the Annual Investment Allowance or the Super Deduction.

Idea 3 – Make any asset disposals before 1/4/22

If you plan to make a profitable disposal (ie sell that company car) then try to do it in an accounting period that ends before 31/3/2022.

Idea 4 – Consider merging and closing small associated companies

If you have more than one company in a group then the £50k and £250k thresholds for 19% and 25% Corporation Tax are reduced. For example, if you have two companies the thresholds become £25k and £125k. This means, that two companies with different profits may pay higher tax than just one company with the same combined profits. Thus it might be slightly cheaper to merge and then close one of the companies. Consider the following example:

You have two associated companies, A and B. A makes profit of £160k and B makes profit of £10k. The tax paid is £41.9k (£160k x 25% + £10k x 19%). If you merge the two companies then you would just have one company that makes £170k. In this case you would pay tax of £38.4k (£170k x 22.6%).

Idea 5 – Bring forward capital expenditure to take advantage of the super deduction

Another idea is to bring forward capital expenditure to before 31/3/2023 to take advantage of the Super Deduction. Note that the super deduction is not applicable for cars or leased assets.

Idea 6 – Bring forward capital expenditure to take advantage of the higher Annual Investment Allowance

Likewise, if you plan to spend more than £200k on capital items its worth bringing forward the capital spend to before 31/3/2023 to take advantage of the higher Annual Investment Allowance.

Idea 7 – Consider changing your year end to 31/3/23

It may be that you have an accounting period that straddles the 31/03/2023 date. In this case it may be worth changing your year end so that you can get the full benefit of the ideas mentioned above. All other things being equal, if you have decreasing profits then this is likely to be advantageous. Whilst if you have increasing profits its likely to be disadvantageous.

Idea 8 – Save National Insurance by paying your pension by Salary Sacrifice

You might be able to save National Insurance by changing to a salary sacrifice scheme. You can read about this in our note here.

Idea 9 – Make sure that you’ve maxed out on your pension

Pension contributions are normally tax deductible for the company and are very tax efficient for the employee. So, if your an owner / manager of a business, its a good idea to make sure that you’ve paid as much as you can into your pension pot. You can read about this here.

Idea 10 – Make sure you’ve utilised your personal allowance and dividend allowance

Each year you are entitled to a tax free personal allowance (£12,570 for the 2021/22 tax year) and a tax free dividend allowance (£2,000 for the tax year 2021/22). If your an owner / manager of a business its worth making sure that you have paid yourself at lest this.

Idea 11 – Buy an electric company car

There are significant tax advantages in buying electric cars with zero emissions through a limited company. For zero emission electric cars the company is allowed a 100% first year allowance and the taxable benefit on the employee is just 2% of the list price from April 2022.

Idea 12 – Pay your staff ‘Trivial benefits’

Trivial benefits paid to your team are usually tax deductible for the company and tax free to the employee. You have to be careful – trivial benefits can’t be cash or vouchers, they can’t be in recognition of services and they can’t exceed £50. Directors have an annual limit of £300 spend, but there’s no limit for employees.

Idea 12.5 – Claim the work from home flat rate charge

If all else fails, you can claim £6 per week if you work from home. Its tax deductible for the company and tax free to the employee. Ps – the heading is named 12.5 because 13 is unlucky!

Next steps

Call us if you would like to talk through any of these.

The tax on companies is going up There are some big tax […]